The Commonwealth National Consumer Credit Protection Act 2009 requires persons who engage in credit activities, such as banks, to be licensed.

From 1 April 2012, whenever a licensee identifies itself in a document prescribed by the National Consumer Credit Protection Regulations 2010, the licensee must also include their Australian Credit Licence (ACL) number.

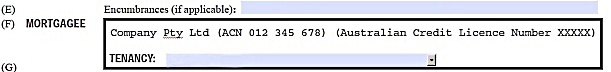

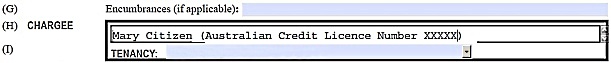

In relation to NSW LRS Real Property Act dealings, licensees can meet any obligations they have under the Act by inserting their Australian Credit Licence number alongside other identifying information in the relevant panel of the form, for example:

Example of entry in RPA dealing - Mortgage (05M)

Example of entry in RPA dealing - Charge (06C)

However NSW LRS will not requisition any dealing in relation to an Australian Credit Licence Number recorded on the dealing form. Nor will NSW LRS query any dealing that does not include an Australian Credit Licence number.